Life Insurance in and around Overland Park

Life goes on. State Farm can help cover it

Life happens. Don't wait.

Would you like to create a personalized life quote?

It's Time To Think Life Insurance

When you're young and just starting out in life, you may think Life insurance isn't necessary when you're still young. But it's a good time to start thinking about Life insurance to prepare for the unexpected.

Life goes on. State Farm can help cover it

Life happens. Don't wait.

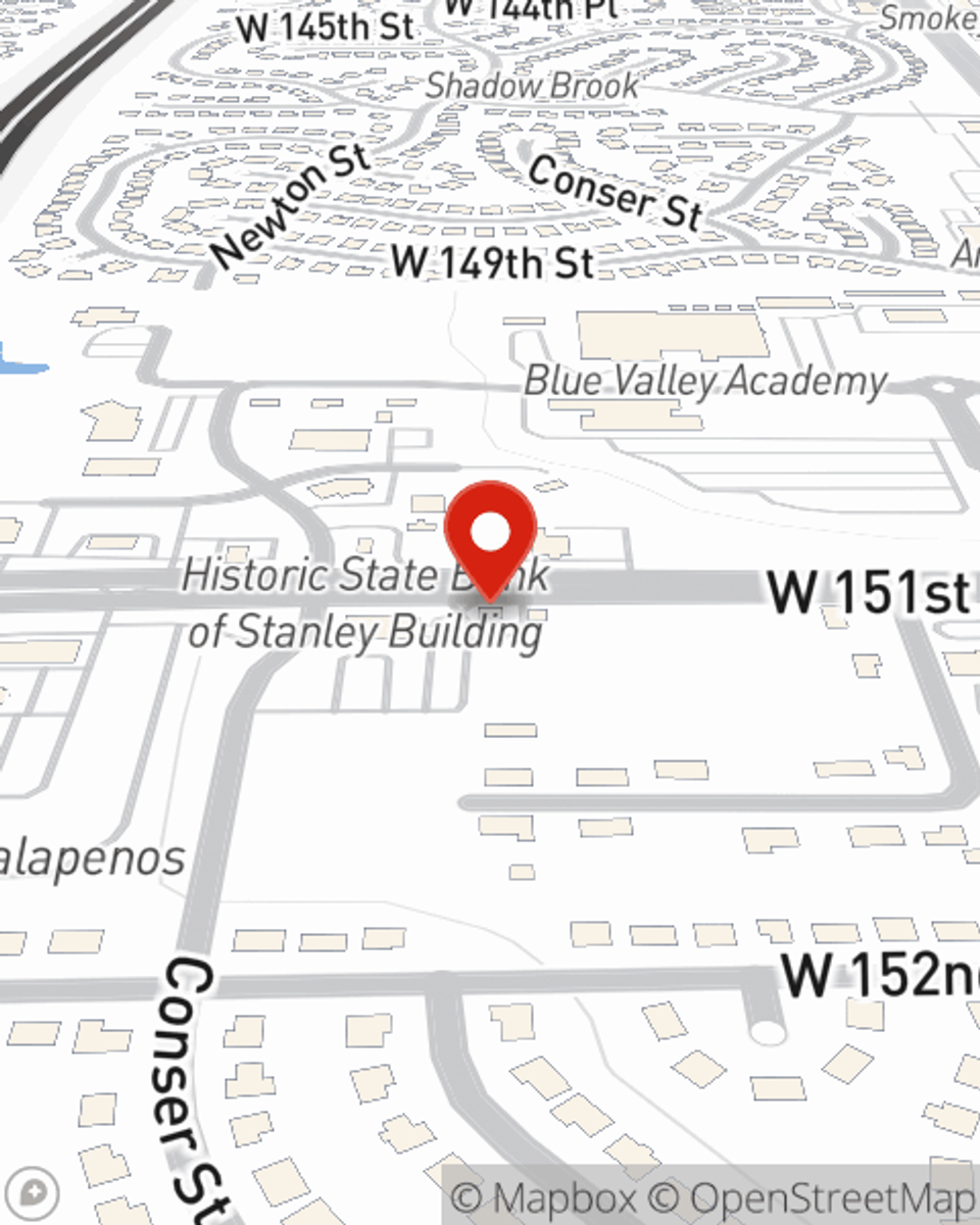

Overland Park Chooses Life Insurance From State Farm

Life can be just as unexpected when you're young as when you get older. That's why now could be a good time to get Life insurance and why State Farm offers a couple of different coverage options. Whether you're looking for coverage for a specific time frame or level or flexible payments with coverage to last a lifetime, State Farm can help you choose the right policy for you.

No matter what place you're at in life, you're still a person who could need life insurance. Call or email State Farm agent Steve Fisher's office to explore the options that are right for you and the ones you love most.

Have More Questions About Life Insurance?

Call Steve at (913) 897-3148 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

What are the different types of insurance?

What are the different types of insurance?

You can have more coverage than just car insurance, homeowners insurance, and life insurance. Learn about options for these and other types of policies.

Life insurance vs annuities

Life insurance vs annuities

Staying informed about how annuities and life insurance work makes it easier to come up with a financial roadmap that's tailored to your needs.

Steve Fisher

State Farm® Insurance AgentSimple Insights®

What are the different types of insurance?

What are the different types of insurance?

You can have more coverage than just car insurance, homeowners insurance, and life insurance. Learn about options for these and other types of policies.

Life insurance vs annuities

Life insurance vs annuities

Staying informed about how annuities and life insurance work makes it easier to come up with a financial roadmap that's tailored to your needs.